Details It Is Important To Find Out About How Do Cardless ATMs Work

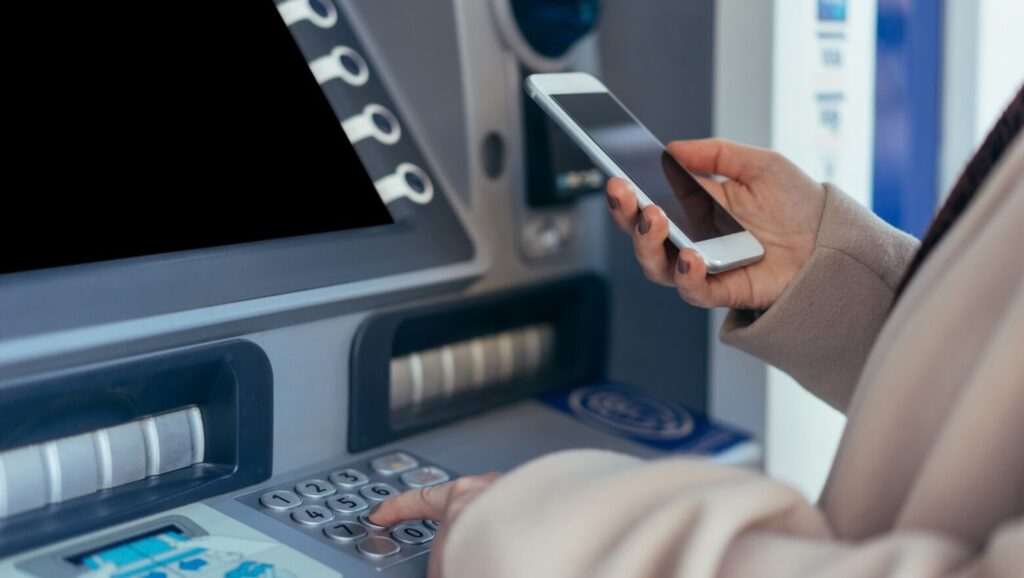

Cardless ATMs are automated teller machines you may use without having a debit card or ATM card. Unlike traditional ATMs, rather than a physical card, you need to use your cellphone to get into the ATM and take care of supported banking transactions. Here’s a closer inspection at how cardless ATMs work and which banks support them.

How can cardless ATMs work?

Cardless ATMs make use of your bank’s mobile app make it possible for ATM access rather than physical bank card. The feature to activate together with your account may fit in one of countless ways.

NFC: Near Field Communication (NFC) may be the technology powering tap-to-pay features included in payment cards and digital wallets. Similar to checking out at the store which has a tap out of your phone, some cardless ATMs let you tap a cell phone or smartwatch connected to your bank’s mobile app to work with an ATM.

QR code: Quick Response (QR) codes are square barcodes you’ve likely seen on posters or other ads allowing you to quickly reach a website. Exactly the same codes could be generated for one-time use. Some bank apps enable you to unlock an ATM by scanning a QR code for the ATM screen from your bank’s app.

Access code: For a few cardless ATMs, you can create your transaction in the bank’s mobile app before approaching the ATM. The app will provide you with a code that’s created the ATM to accomplish the transaction.

Every bank and ATM network uses proprietary software to own its ATMs. Occasionally, a bank’s new ATMs support cardless features while older machines still require atm cards. If you’re unsure if you’ll be able to find a cardless ATM, it’s still a good idea to carry your card with you to help you access fast cash in an emergency. Later on, fat loss ATMs offer cardless functionality, cards may go from the wayside.

Advantages of cardless ATMs

Less opportunity for card fraud

When someone with bad intentions gets their hands on your card and PIN, they are able to readily ATM to drain your bank account. As soon as your card is safely hidden so you takes place mobile phone on the ATM, you’ve less risk of someone else stealing and using your card.

Convenient use with no physical card

One fewer card can lighten your load or shrink your wallet. There’s no need to concern yourself with forgetting your ATM card in your house. A lot of people never leave home without their phone, and cardless ATMs enable you to produce a withdrawal with your cherished cell phone.

Disadvantages of cardless ATMs

Potential for security breach if you lose your phone

In the event you lose your phone and don’t have strong security measures to hold it locked, it’s simple for a thief to open up your bank’s app and access your accounts. Taking full benefit of your phone’s most dependable locking features and using strong passwords helps keep the unhealthy guys from exploding in case your phone the skin loses or stolen. To look a stride further, consider adding remote tracking and wipe capabilities through your Google, Apple, or even a third-party security app.

Your phone needs to work

In case your phone needs recharging or has other issues, you won’t be capable of access your hard earned money.

Utilizing a cardless ATM

Cardless ATMs are easy to use when you know the way they work. Follow these simple measures to employ a cardless ATM with NFC:

Pre-ATM setup: Enable NFC on your own smartphone and add your card on your mobile wallet app or create your bank’s mobile app, according to your bank’s requirements for utilizing an ATM with cardless features. Verify the card, usually through an SMS or email code.

Look for a compatible ATM: Use your bank’s mobile app to find an ATM with cardless, NFC capabilities. Seek out the NFC logo on the machine.

Ready your mobile wallet: When you approach the ATM, open your mobile wallet and judge the charge card you intend to utilize.

Tap and authenticate: Select the cardless option about the ATM menu, then tap your phone to the NFC reader. Authenticate through your mobile wallet’s security feature.

Transact and collect: Proceed with your desired transaction, collect your money and receipt, and you’re simply fine.

The steps are very different when utilizing a QR code or ATM access code by your bank’s mobile app, but you’ll still use your phone to authenticate with all the machine before proceeding along with your transaction. Once you’ve unlocked the ATM with your account, it’s just like using an ATM for any traditional card-based transaction.

More information about Cardless ATM visit this web portal

Leave a Reply

You must be logged in to post a comment.